Our technology in use: application areas and success stories

Immediate monetization through increased sales to your customers and automation of your processes

Immediately applicable

More revenue with customers

Automated processes

Proven in practice

Numerous use cases with fast monetization

Die Einsatzmöglichkeiten von Finanzmining sind so vielfältig wie die Echtzeit-Analytics-Funktionen, die wir anbieten. Eines haben sie alle gemeinsam: Sie wollen den Umsatz mit Ihren Kunden steigern oder die Effizienz der Kundenbearbeitung steigern. Daher benötigen Sie detaillierte Informationen über Ihre Kunden, also zu finanzieller Fitness, Einnahme- und Ausgabenquellen, Finanzverhalten und Finanzperformance, Leistungsvermögen und der finanziellen Zukunft. Daraus ergeben sich Beratungs- und Vertriebssignale, Ansatzpunkte für Up- und Cross-Selling sowie Finanzindikatoren, die zur Automatisierung Ihrer Prozesse oder Ihre regulatorischen Abläufe von Bedeutung sind.

360-degree customer analysis

Seeing and understanding customers more clearly is the starting point for a multitude of opportunities to increase revenue and reduce costs.in finance, but also in other sectors.

In particular, we support use cases with rapid revenue growth or comprehensive automation and better risk management of your processes.

Customer Early Indicators

Early indicators are essential to be first on the ball when business opportunities arise or actions need to be taken at the customer’s site.

We support use cases based on the detailed financial development of the customer. This also includes the identification of customers in transition as well as the anticipation of important customer events.

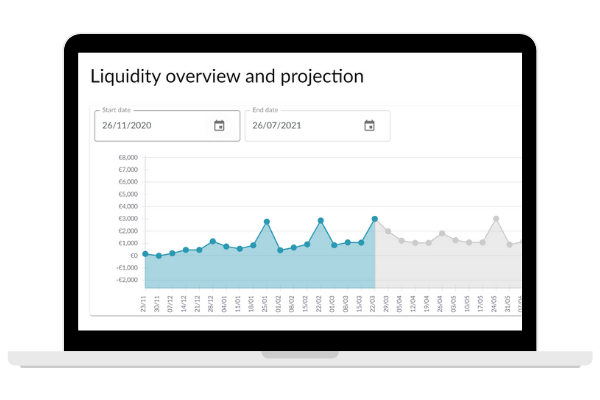

Financial forecasting and planning

For applications in the financial planning area and for early detection of action signals, it is necessary to forecast future customer finances as early and as accurately as possible.

The basis for this is our daily booking forecast with no time limit. Extensive financial series are derived from this, as well as financial or asset planning and scenario considerations.

We enable use cases in the private customer sector such as financial, retirement and asset planning. And for business customers, we have a financial radar that optimizes financial fitness and provides timely recommendations on how to optimize finances before bottlenecks arise.

Automated financial processes

For fast decisions as well as cost-effective processes, it is essential to automate financial processes. Furthermore, risks can be managed and minimized much more accurately by using the full range of information revealed by our real-time analytics of financial data.

Important processes we support include automated credit decisioning and secure customer identification and verification.

Efficient risk management

We understand this to mean, on the one hand, the (automated) avoidance of risks through more detailed data on customers and activities. And on the other hand, it includes possible more precise risk management. More factors can then be taken into account than would normally be the case, allowing a finer identification of risk.

Better management of credit business and facilitation of money laundering prevention are just two of the use cases where efficiency can be increased through our analytics.

Consumption and financial targeting

Precise knowledge of the customer and his spending behavior are at the core of all targeted sales, up-selling, cross-selling and customer retention measures.

Our technological basis allows the use of 50,000 criteria that can be used for targeting or customer retention. We also provide the right times at which interest and demand for certain products and services are particularly high.

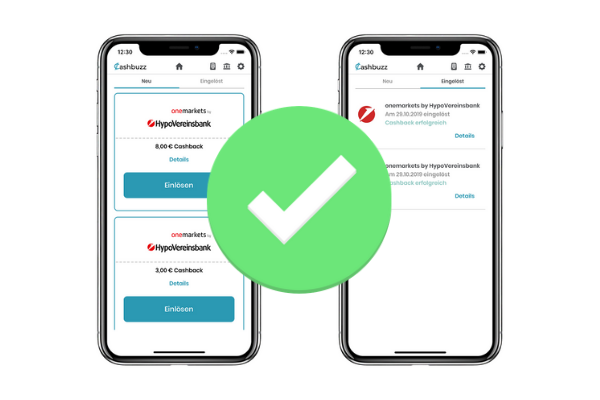

Cashback Trading

Cashback trading is a synonym for higher customer loyalty of investors through certain incentives. The classic example is the reimbursement of order fees for products of certain issuers, regardless of which broker or bank the customer is with.

We recognize all relevant financial activities and constellations of the investor and offer an end-to-end process where generation, approval and settlement are available efficiently (up to full automation) and fully configurable.

You don’t have to implement anything either. We offer a complete white-label solution here that you can start using immediately.